To control your spending and be a financially responsible person, you need to follow a few simple steps. Try the following six tips to manage your monthly expenses and simplify the budgeting process.

1. How To Create A Budget

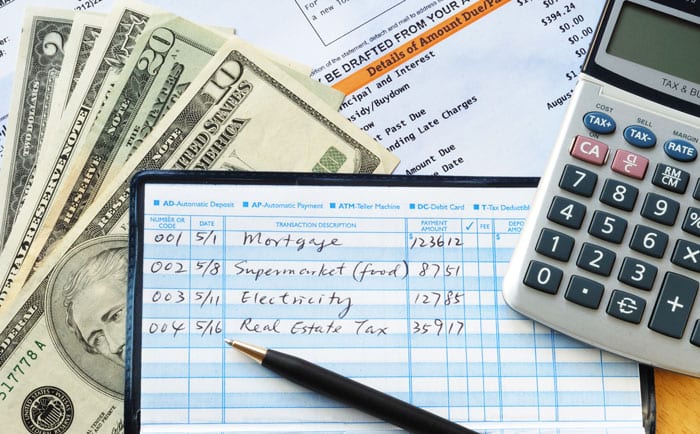

The first step to creating a budget is to get all your financial information together. It includes bank statements, utility bills, credit card bills and receipts related to your expenses from the last three months.

Write down your total income on the top of a piece of paper or Excel sheet. Then, add the breakup of all your expenses in a category-wise manner under the heads of fixed expenses and variable expenses.

Under fixed expenses, you can also make an approximate value of monthly utility bills. Variable costs include groceries, fuel, entertainment and eating out. It’s a good idea to have a monthly amount under the head of ’emergency fund’.

Now, take a good look at the total expenses to see if you’re spending more than you earn. If there is little or no cash left at the end of the month, make adjustments in particular expenses. Update your budget every six months, preferably.

2. Prioritise Your Payments

You need to prioritise your payments, and stashing away your savings amount should be the first preference, even before you go out to buy groceries. If you need to move money into particular accounts for investments, do it first.

It is a good idea to allocate 20% to 30% of your salary into savings. Your savings can be short-term or long-term. Long-term savings are investment vehicles like a systematic investment plan (SIP) or an Individual Savings Account (ISA).

Short-term investments can come in the form of a jam jar account, a separate bank account from which you can get help for paying bills that are recurring like college fees, annual insurance premiums, etc.

Once you have diverted your investment and savings, then focus on the rest of the items in your budget. Remember to prioritise your payments so that the least essential things (like eating out or ordering in) come last.

3. Make Shopping Lists

When you finally do reach the supermarket, do not leave before you have a shopping list ready. It is the best remedy for impulsive buyers. The shelves of supermarkets are arranged in such a way as to entice you to pick up stuff.

Your shopping list will contain all the items that you usually buy because they are economical and (hopefully) healthy. When you prepare your list in the comfort of your home, you will make a list that is kind to your pocket as well as your health.

It is possible that even armed with a list, you may see something attractive. Be very wary of buying such things. Ask yourself whether you really need it, and if you purchased it, how would it improve your quality of life?

4. Do Not Use Your Credit Card For Credit

A credit card is a double-edged sword. Nowadays, credit cards are the easiest things to get. You get offers on your email, SMS and numerous marketing calls offering low-interest credit cards.

Once you have a credit card or two, life’s good. Or so it may seem when you are swiping them for goodies. But the difference between a debit and credit card is that you use your own money with a debit card, but you borrow money with a credit card.

Borrowing is acceptable if you have the means to pay back what you’ve borrowed within a stipulated time. The difficulty arises when you overspend and are unable to pay back the full amount. Credit card companies depend on you to do this.

When you default on your payments or cannot clear the full bill by the due date, the interest you pay is enormous. Credit card companies earn their primary income from fees and interest. They depend on your overspending to earn money.

Hence, only use your credit card to the extent that you can pay back. Don’t overspend and give away your hard-earned money to a credit card company.

5. Use Budgeting Apps

When you create your budget, you don’t have to do everything manually. You can use apps that will help you set up your budget and monitor your financial activities. Hence, you can keep the app running and get updates on your phone.

Budgeting apps connect up all your financial accounts to keep track of your spending. You can set your goals and priorities, and the app will provide you with a steady flow of graphically represented information.

With all your financial info on colourful charts and tables, keeping track of your budget suddenly becomes a fun thing to do. Some apps even provide you with investment advice, suggesting where you can invest surplus funds when available.

Add Comment